All Categories

Featured

Table of Contents

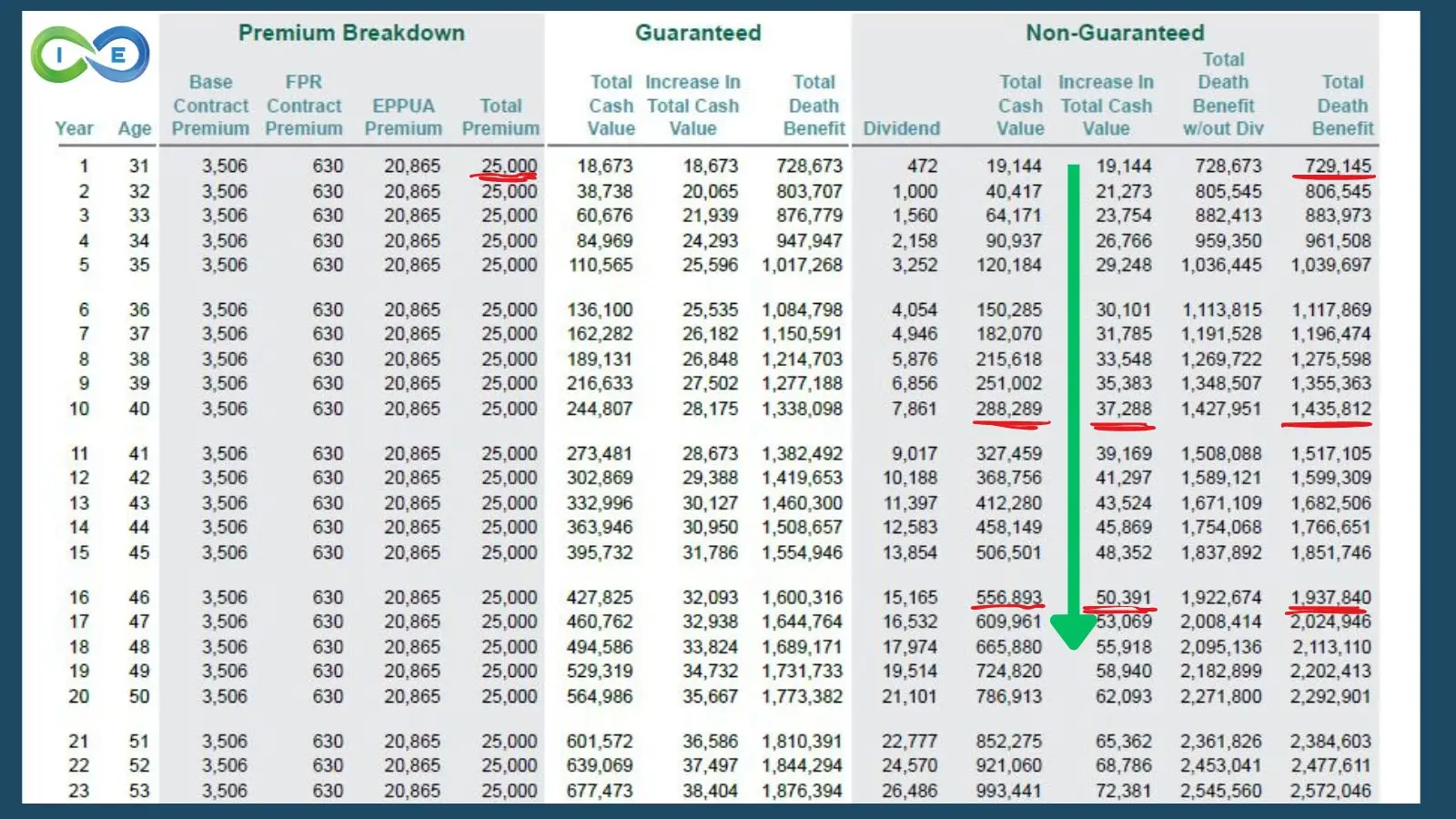

Utilizing the above instance, when you get that very same $5,000 lending, you'll make rewards on the entire $100,000. It's still completely funded in the eyes of the common life insurance policy company. For limitless banking, non-direct recognition plan financings are ideal. Finally, it's essential that your policy is a mixed, over-funded, and high-cash worth policy.

Riders are added functions and advantages that can be included to your policy for your certain requirements. They allow the insurance holder purchase much more insurance coverage or transform the problems of future acquisitions. One reason you might want to do this is to plan for unexpected illness as you get older.

If you include an additional $10,000 or $20,000 upfront, you'll have that cash to the financial institution initially. These are just some steps to take and consider when establishing up your lifestyle banking system. There are a number of different ways in which you can maximize way of living banking, and we can assist you discover te best for you.

Wealth Nation Infinite Banking

When it comes to financial preparation, entire life insurance coverage usually stands out as a prominent option. While the concept might sound appealing, it's important to dig deeper to recognize what this actually implies and why checking out entire life insurance coverage in this method can be deceptive.

The idea of "being your very own bank" is appealing since it recommends a high degree of control over your finances. However, this control can be illusory. Insurance policy companies have the ultimate say in how your policy is taken care of, including the terms of the lendings and the rates of return on your cash value.

If you're taking into consideration entire life insurance policy, it's vital to see it in a more comprehensive context. Entire life insurance policy can be a useful device for estate planning, supplying an assured fatality advantage to your recipients and possibly supplying tax obligation benefits. It can likewise be a forced financial savings automobile for those who have a hard time to save money constantly.

It's a type of insurance policy with a cost savings element. While it can offer constant, low-risk development of money value, the returns are generally lower than what you might achieve via various other investment lorries. Prior to jumping right into entire life insurance policy with the idea of limitless banking in mind, put in the time to consider your monetary goals, danger tolerance, and the complete variety of economic items readily available to you.

Limitless financial is not an economic remedy. While it can operate in particular circumstances, it's not without dangers, and it calls for a substantial commitment and understanding to take care of successfully. By identifying the possible challenges and understanding the true nature of entire life insurance policy, you'll be much better equipped to make an enlightened decision that sustains your economic wellness.

As opposed to paying banks for things we need, like autos, residences, and institution, we can buy methods to keep more of our money for ourselves. Infinite Financial method takes an advanced method towards individual money. The method basically entails becoming your own financial institution by making use of a dividend-paying entire life insurance plan as your financial institution.

Banking Concepts

It supplies significant growth over time, changing the common life insurance policy policy right into a sturdy monetary device. While life insurance policy firms and banks take the chance of with the variation of the market, the negates these dangers. Leveraging a cash value life insurance plan, people appreciate the benefits of guaranteed development and a survivor benefit secured from market volatility.

The Infinite Banking Concept shows exactly how much wealth is completely moved away from your Family members or Organization. Nelson also goes on to explain that "you finance everything you buyyou either pay interest to another person or surrender the passion you could have otherwise gained". The genuine power of The Infinite Banking Concept is that it solves for this trouble and encourages the Canadians who accept this principle to take the control back over their funding needs, and to have that money receding to them versus away.

This is called shed chance cost. When you pay money for things, you completely surrender the chance to gain passion on your very own savings over several generations. To solve this problem, Nelson created his own banking system through using returns paying participating entire life insurance coverage policies, ideally with a common life business.

As an outcome, insurance holders need to meticulously review their monetary goals and timelines before deciding for this method. Authorize up for our Infinite Banking Program.

Nelson Nash Infinite Banking Book

Just how to obtain Continuous COMPOUNDING on the routine payments you make to your financial savings, emergency situation fund, and retired life accounts How to position your hard-earned cash so that you will certainly never ever have an additional sleep deprived evening stressed about how the markets are going to respond to the next unfiltered Governmental TWEET or global pandemic that your family members just can not recover from How to pay yourself first making use of the core principles educated by Nelson Nash and win at the cash video game in your very own life Exactly how you can from third celebration banks and loan providers and move it into your very own system under your control A streamlined means to make certain you pass on your wealth the method you want on a tax-free basis How you can move your cash from for life strained accounts and shift them right into Never tired accounts: Hear specifically how individuals just like you can execute this system in their own lives and the effect of putting it into activity! The duration for establishing and making substantial gains via limitless financial mainly depends on numerous elements distinct to an individual's financial placement and the policies of the financial institution providing the solution.

In addition, an annual dividend settlement is an additional huge advantage of Boundless banking, more emphasizing its good looks to those geared towards long-term financial development. Nevertheless, this strategy requires mindful consideration of life insurance coverage costs and the analysis of life insurance coverage quotes. It's important to analyze your credit report and challenge any kind of existing charge card debt to guarantee that you are in a beneficial placement to take on the technique.

A crucial facet of this strategy is that there is ignorance to market fluctuations, due to the nature of the non-direct recognition car loans made use of. Unlike financial investments linked to the volatility of the marketplaces, the returns in boundless financial are stable and predictable. However, extra money over and over the premium settlements can additionally be contributed to speed up development.

Infinite Banking Video

Policyholders make regular costs settlements right into their getting involved entire life insurance coverage policy to keep it active and to build the policy's overall cash value. These premium payments are generally structured to be regular and predictable, ensuring that the policy remains active and the money worth remains to expand with time.

The life insurance coverage plan is developed to cover the whole life of an individual, and not just to aid their recipients when the specific passes away. That said, the plan is participating, suggesting the policy proprietor becomes a component owner of the life insurance coverage firm, and joins the divisible revenue generated in the kind of dividends.

"Below comes Earnings Canada". That is not the case. When returns are chunked back right into the plan to acquire compensated enhancements for no added expense, there is no taxed event. And each paid up enhancement likewise receives rewards every year they're stated. Now you might have heard that "dividends are not assured".

Table of Contents

Latest Posts

Infinite Banking Toolkit

Infinite Banking Policy

Infinite Banking Spreadsheet

More

Latest Posts

Infinite Banking Toolkit

Infinite Banking Policy

Infinite Banking Spreadsheet